What Is IPERS: A Comprehensive Guide To Understanding Iowa's Public Retirement System

IPERS, or the Iowa Public Employees' Retirement System, is a crucial component of financial security for public employees in the state of Iowa. If you're an Iowa public employee, understanding IPERS is essential for planning your future and ensuring financial stability after retirement. This comprehensive guide will walk you through everything you need to know about IPERS, from its history and benefits to how you can maximize your retirement savings through this system.

Established in 1953, IPERS serves over 370,000 active and retired members, making it one of the largest public retirement systems in the United States. This defined benefit plan offers guaranteed lifetime benefits to eligible members, providing peace of mind and financial security during retirement years. With its strong funding ratio and commitment to member services, IPERS stands as a testament to Iowa's dedication to supporting its public workforce.

In this article, we'll explore the intricacies of IPERS, including its structure, benefits, contribution requirements, and strategies for maximizing your retirement benefits. Whether you're a new public employee just starting your career or approaching retirement age, understanding how IPERS works is crucial for making informed decisions about your financial future. We'll also address common questions and concerns about the system, helping you navigate this important aspect of your employment benefits.

Read also:When Was Doraemon Invented A Comprehensive Guide To The Beloved Robot Cat

Table of Contents

- The History and Evolution of IPERS

- Key Benefits of IPERS Membership

- Understanding IPERS Contribution Structure

- Eligibility Requirements and Enrollment Process

- How IPERS Benefits Are Calculated

- Planning Your Retirement with IPERS

- IPERS Investment Strategy and Performance

- Additional Resources and Support for Members

- The Future of IPERS and Policy Developments

- Conclusion and Next Steps

The History and Evolution of IPERS

The Iowa Public Employees' Retirement System was established in 1953 through the Iowa Legislature, initially covering only state employees. Over the decades, IPERS has expanded its membership to include local government employees, teachers, law enforcement officers, and other public sector workers. This growth has transformed IPERS into one of the largest public retirement systems in the nation, serving members across all 99 counties of Iowa.

Throughout its history, IPERS has maintained a strong funding position, consistently ranking among the best-funded public pension systems in the United States. According to the 2022 Comprehensive Annual Financial Report, IPERS maintains a funding ratio of 84.2%, significantly higher than the national average for public pension funds. This financial stability has been achieved through prudent investment strategies and careful management of member contributions.

Several key milestones have shaped IPERS's development: the introduction of cost-of-living adjustments (COLAs) in 1974, the implementation of modern record-keeping systems in the 1990s, and the recent launch of online member services. These advancements have enhanced the system's ability to serve its growing membership while maintaining its core mission of providing secure retirement benefits.

Key Benefits of IPERS Membership

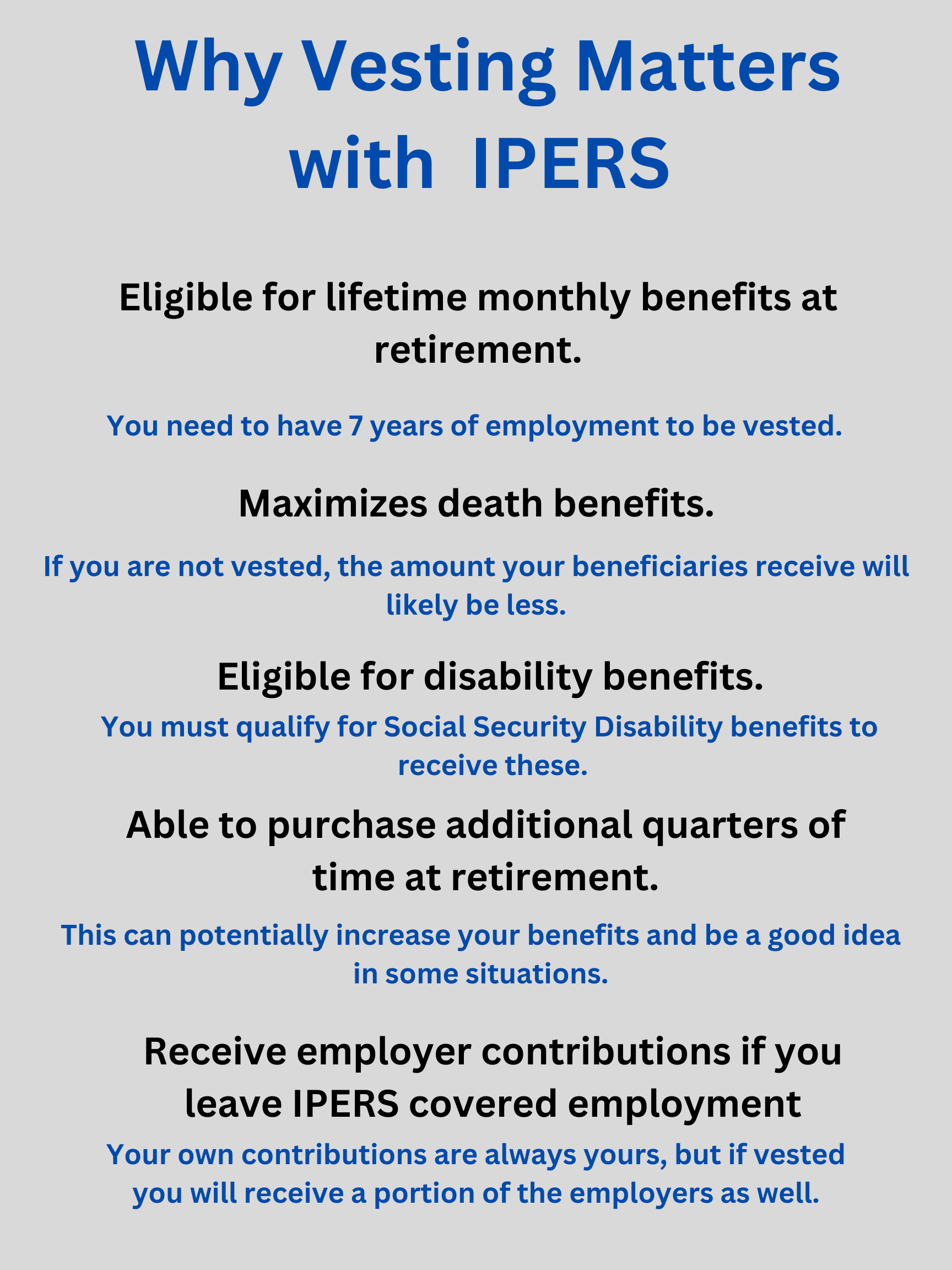

IPERS offers numerous advantages to its members, making it a valuable component of public employment in Iowa. The primary benefit is the guaranteed lifetime retirement annuity, which provides members with a stable income stream throughout their retirement years. Unlike defined contribution plans, IPERS benefits are not subject to market fluctuations, offering members peace of mind and financial security.

Additional benefits include:

- Survivor benefits for spouses and dependents

- Disability benefits for members unable to work

- Refund options for members who leave public service

- Portability between eligible public employers

- Regular cost-of-living adjustments (COLAs)

Members also benefit from professional investment management of their retirement funds. The IPERS investment team follows a diversified strategy that includes domestic and international equities, fixed income securities, real estate, and alternative investments. This approach has yielded an average annual return of 7.5% over the past 30 years, significantly contributing to the system's financial health and benefit security.

Read also:1965 Chinese Zodiac Unveiling The Year Of The Snake

Understanding IPERS Contribution Structure

IPERS operates on a shared contribution model between employees and employers. Employee contributions are fixed at 7.44% of regular compensation, while employers contribute varying amounts based on their specific actuarial rates. These contributions are automatically deducted from members' paychecks and deposited directly into the IPERS trust fund.

Here's a breakdown of the contribution process:

- Employee contributions are pre-tax, reducing taxable income

- Employer contributions vary based on actuarial rates (typically 8-12%)

- Contributions are invested in a diversified portfolio

- No individual accounts – funds are pooled for investment efficiency

It's important to note that member contributions are fully vested immediately, meaning you retain your contributions even if you leave public service before retirement. Additionally, IPERS contributions are exempt from Iowa state income tax, providing members with additional tax benefits.

Eligibility Requirements and Enrollment Process

To qualify for IPERS membership, individuals must be employed by an eligible public employer in Iowa. This includes state agencies, municipalities, school districts, community colleges, and other qualifying government entities. Eligible positions typically include full-time, permanent employees who work at least 20 hours per week.

The enrollment process is straightforward:

- Employer completes and submits an IPERS membership application

- New members receive an IPERS account number and welcome packet

- Members verify personal information and beneficiary designations

- Contribution deductions begin automatically

For those wondering about specific eligibility criteria, here's a quick reference:

| Requirement | Details |

|---|---|

| Age | No minimum age requirement |

| Employment Status | Must be employed by eligible public entity |

| Work Hours | Minimum 20 hours per week |

| Position Type | Permanent, full-time positions |

How IPERS Benefits Are Calculated

IPERS retirement benefits are calculated using a straightforward formula that considers three key factors: years of service, final average salary (FAS), and a benefit multiplier. The basic calculation is:

Annual Benefit = Years of Service × Final Average Salary × Benefit Multiplier

Let's break down each component:

- Years of Service: Each full year of eligible employment counts as one year

- Final Average Salary: Highest 36 consecutive months of compensation

- Benefit Multiplier: Currently set at 1.96% for most members

For example, consider a teacher with 30 years of service and a final average salary of $60,000:

Annual Benefit = 30 × $60,000 × 0.0196 = $35,280

Retirement Options and Choices

Upon retirement, IPERS members can choose from several payment options:

- Single Life Annuity: Maximum monthly benefit for member's lifetime

- Joint and Survivor Annuity: Reduced benefit with survivor protection

- 10-Year Certain Option: Guarantees payments for at least 10 years

Survivor Benefits and Protections

IPERS provides robust survivor benefits, including:

- Spousal benefits for surviving partners

- Children's benefits for eligible dependents

- Pre-retirement death benefits

Planning Your Retirement with IPERS

Effective retirement planning with IPERS requires understanding several key factors. Members typically become eligible for retirement benefits at age 55 with at least five years of service credit. However, waiting until full retirement age (65) or accumulating more service years can significantly increase monthly benefits.

When planning your retirement, consider these important aspects:

- Service credit purchase opportunities

- Impact of early retirement reductions

- Coordination with Social Security benefits

- Health insurance options post-retirement

IPERS Investment Strategy and Performance

IPERS maintains a diversified investment portfolio managed by professional investment staff. The current asset allocation includes:

- 45% Domestic Equities

- 20% International Equities

- 25% Fixed Income

- 10% Real Assets and Alternatives

This strategy has yielded strong returns, with a 30-year annualized return of 7.5%. The system's investment policy emphasizes long-term growth while managing risk through diversification and active management.

Additional Resources and Support for Members

IPERS provides numerous resources to help members understand and manage their retirement benefits:

- Online member portal for account access

- Annual benefit statements

- Retirement planning workshops

- Dedicated member services representatives

Members can also access educational materials, including:

- Benefit calculation guides

- Retirement planning checklists

- Video tutorials

The Future of IPERS and Policy Developments

Looking ahead, IPERS faces several challenges and opportunities. Key areas of focus include:

- Addressing demographic shifts in membership

- Managing investment risks in changing markets

- Enhancing digital services for members

- Ensuring long-term sustainability of benefits

Recent policy developments have focused on improving system efficiency and member services. These include enhancements to the online member portal, expanded educational resources, and updated communication strategies to better serve the diverse IPERS membership.

Conclusion and Next Steps

Understanding IPERS is crucial for Iowa public employees planning their financial future. This comprehensive retirement system offers guaranteed lifetime benefits, survivor protections, and professional investment management, making it a valuable component of public employment in Iowa. By understanding how IPERS works, members can make informed decisions about their retirement planning and maximize their benefits.

We encourage you to take the following steps:

- Review your annual benefit statement

- Attend IPERS educational workshops

- Update your beneficiary information regularly

- Consult with a financial advisor about retirement planning

For more information, visit the official IPERS website or contact their member services department. Remember that understanding your retirement benefits is an ongoing process, and staying informed will help ensure financial security throughout your retirement years. Share this article with fellow IPERS members and leave your questions or experiences in the comments below.

Rowan Atkinson And UKIP: A Closer Look At The Actor's Political Views

Lily Thai: The Versatile Actress Who Redefined Entertainment

Is Longlegs On Prime? Everything You Need To Know About Streaming This Horror Film

IPERS — Teacher Wealth

Retirement Benefit Calculation Iowa Public Employees’ Retirement System