Iowa Public Employee Retirement System: A Comprehensive Guide

The Iowa Public Employee Retirement System (IPERS) plays a critical role in securing the financial future of public employees in Iowa. As one of the largest retirement systems in the state, it provides a reliable and sustainable source of income for retirees who have dedicated their careers to public service. Understanding how IPERS works is essential for both current and future beneficiaries, as it directly impacts their retirement planning. With its defined benefit structure, IPERS ensures that members receive a guaranteed income stream during their retirement years.

For many public employees in Iowa, the retirement system is more than just a financial tool; it is a promise of stability and security after years of service. Whether you are a teacher, firefighter, police officer, or a state employee, IPERS is designed to support you throughout your post-employment life. In this article, we will explore the intricacies of the Iowa Public Employee Retirement System, its benefits, eligibility criteria, and how it operates. By the end, you will have a clear understanding of how IPERS can help you achieve financial peace of mind.

This guide will also address frequently asked questions, provide valuable insights, and offer practical advice for maximizing your retirement benefits. Whether you are just starting your career in public service or are nearing retirement, this article is tailored to help you navigate the complexities of IPERS. Let’s dive into the details and uncover everything you need to know about this vital retirement system.

Read also:When Was Doraemon Invented A Comprehensive Guide To The Beloved Robot Cat

Table of Contents

What is the Iowa Public Employee Retirement System?

The Iowa Public Employee Retirement System (IPERS) is a defined benefit retirement plan designed to provide financial security to public employees in Iowa. Established as a state-sponsored program, IPERS ensures that members receive a predictable and reliable income stream during their retirement years. Unlike defined contribution plans, where the retirement benefits depend on investment performance, IPERS guarantees a fixed monthly payment based on factors such as years of service and salary history.

Key Features of IPERS

- Defined Benefit Structure: Members receive a guaranteed monthly benefit upon retirement.

- State Oversight: IPERS is managed by the State of Iowa, ensuring transparency and accountability.

- Investment Pool: Contributions from members and employers are pooled and invested to generate returns.

- Long-Term Sustainability: The system is designed to remain financially stable for decades to come.

History of IPERS

The Iowa Public Employee Retirement System was established in 1953 to provide retirement benefits to public employees in the state. Over the years, IPERS has grown significantly, expanding its membership base and refining its operations. Today, it serves over 370,000 active and retired members, making it one of the largest public retirement systems in Iowa.

Evolution of IPERS

- 1953: IPERS was created to address the retirement needs of public employees.

- 1980s: The system underwent significant reforms to improve funding and sustainability.

- 2000s: IPERS implemented advanced investment strategies to enhance returns.

- Present Day: IPERS continues to adapt to changing economic conditions while maintaining its commitment to members.

How Does IPERS Work?

IPERS operates on a simple yet effective principle: members and their employers contribute a percentage of their salary to the retirement fund. These contributions are pooled and invested in a diversified portfolio to generate returns. Upon retirement, members receive a monthly benefit based on their years of service and final average salary.

Contribution Structure

- Member Contributions: Members contribute a fixed percentage of their salary, which is tax-deferred.

- Employer Contributions: Employers match the contributions, ensuring a stable funding source.

- Investment Returns: The pooled funds are invested in stocks, bonds, and other assets to grow the fund.

Eligibility Criteria for IPERS

To qualify for IPERS benefits, individuals must meet specific eligibility requirements. These criteria ensure that only eligible public employees can participate in the system.

Basic Eligibility Requirements

- Employment Type: Must be employed by a participating public employer in Iowa.

- Age and Service: Members must meet the minimum age and years of service requirements to retire.

- Contribution History: Regular contributions to the system are mandatory.

Benefits of Joining IPERS

Joining IPERS offers numerous advantages for public employees in Iowa. From financial security to long-term stability, the system provides a range of benefits that make it an attractive option for retirement planning.

Top Benefits of IPERS

- Guaranteed Income: Members receive a fixed monthly benefit for life.

- Tax Advantages: Contributions are tax-deferred, reducing taxable income during employment.

- Survivor Benefits: Spouses and dependents may receive benefits after the member’s death.

- Cost-of-Living Adjustments: Benefits are adjusted periodically to account for inflation.

Calculating Retirement Benefits

Understanding how IPERS calculates retirement benefits is crucial for effective retirement planning. The formula takes into account factors such as years of service, final average salary, and a benefit multiplier.

Read also:Nobisuke Nobi A Deep Dive Into The Iconic Father Figure Of Doraemon

Retirement Benefit Formula

Retirement benefits are calculated using the following formula:

Monthly Benefit = (Years of Service × Final Average Salary × Benefit Multiplier)

- Years of Service: Total years worked as a public employee in Iowa.

- Final Average Salary: Average salary over the highest-paid years.

- Benefit Multiplier: A fixed percentage determined by IPERS.

IPERS Investment Strategy

IPERS employs a diversified investment strategy to ensure long-term growth and stability. The system’s investment portfolio includes a mix of stocks, bonds, real estate, and alternative assets.

Key Investment Principles

- Diversification: Investments are spread across various asset classes to reduce risk.

- Long-Term Focus: The strategy emphasizes sustainable growth over decades.

- Risk Management: Rigorous risk assessment and mitigation strategies are in place.

Common Questions About IPERS

Here are answers to some frequently asked questions about the Iowa Public Employee Retirement System:

FAQs

- Can I withdraw my contributions if I leave my job? Yes, but you may forfeit employer contributions and interest.

- How do I apply for retirement benefits? Submit an application through the IPERS website or contact their office.

- Are IPERS benefits taxable? Benefits are subject to federal income tax but exempt from Iowa state tax.

Retirement Planning Tips for IPERS Members

Effective retirement planning is essential for maximizing your IPERS benefits. Here are some tips to help you prepare for a secure financial future:

- Start Early: Begin planning as soon as you join IPERS.

- Monitor Contributions: Regularly review your contributions and adjust if necessary.

- Understand Your Benefits: Familiarize yourself with the retirement benefit formula.

- Consult a Financial Advisor: Seek professional advice for personalized planning.

Conclusion

The Iowa Public Employee Retirement System is a cornerstone of financial security for public employees in Iowa. With its defined benefit structure, tax advantages, and long-term sustainability, IPERS provides a reliable source of income during retirement. By understanding how the system works and planning effectively, you can maximize your benefits and enjoy a comfortable post-employment life.

We encourage you to explore the resources available on the IPERS website and consult with financial experts to create a comprehensive retirement plan. If you found this guide helpful, please share it with others who may benefit from it. For more information on retirement planning and financial advice, check out our other articles on this site. Your future self will thank you for taking the time to plan wisely!

1996 Makeup Trends: A Nostalgic Dive Into The Iconic Beauty Looks Of The 90s

Saying Goodbye In Hawaiian: A Heartfelt Farewell With Aloha Spirit

Understanding YAPMD: A Comprehensive Guide To Boost Your Online Presence

Public Employee Retirement System hosts meeting The Tribune The Tribune

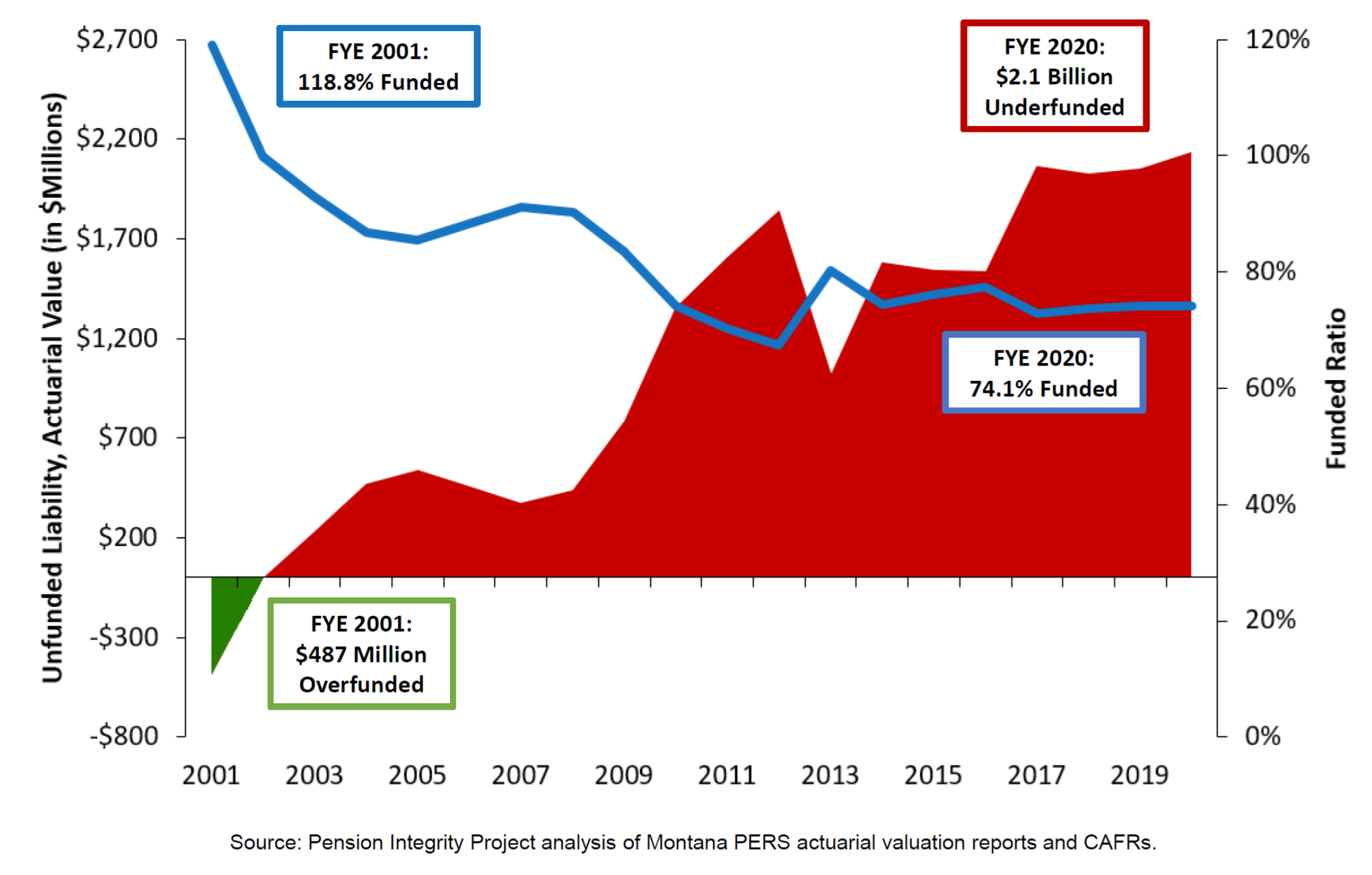

Montana Public Employee Retirement System (MPERS) Solvency Analysis