Fort Bend County CAD: A Comprehensive Guide To Property Assessment And Taxation

Fort Bend County CAD plays a pivotal role in property assessment and taxation in Texas. If you're a homeowner, investor, or simply someone interested in understanding how property taxes work in this region, you've come to the right place. This guide will explore everything you need to know about the Fort Bend County Central Appraisal District (CAD), its functions, and its impact on property owners. Whether you're new to the area or a long-time resident, understanding the role of the CAD can help you make informed decisions about your property and finances.

Fort Bend County CAD is responsible for assessing property values in Fort Bend County, a task that directly affects property taxes. The district ensures that property valuations are fair, accurate, and compliant with Texas state laws. With property taxes being a significant financial obligation for many residents, understanding how the CAD operates is crucial. This article will delve into the intricacies of property assessment, the role of the CAD, and how you can navigate the system effectively.

In the following sections, we'll cover the history of Fort Bend County CAD, its functions, how property assessments are conducted, and what you can do if you disagree with your property valuation. We'll also provide practical tips for property owners and address frequently asked questions. By the end of this article, you'll have a comprehensive understanding of Fort Bend County CAD and its importance in the local real estate landscape.

Read also:Sonya Mcgaffey Age A Comprehensive Guide To Her Life And Career

Table of Contents

Introduction to Fort Bend County CAD

Fort Bend County Central Appraisal District (CAD) is a government entity tasked with assessing property values within Fort Bend County, Texas. Established under Texas law, the CAD operates independently to ensure fairness and transparency in property valuation. The assessed values determined by the CAD are used by local taxing authorities, such as school districts and municipalities, to calculate property taxes.

The CAD's primary mission is to provide accurate and equitable property valuations. This ensures that property taxes are distributed fairly among residents and businesses. By adhering to state guidelines and utilizing modern appraisal techniques, the CAD strives to maintain public trust and uphold the integrity of the property tax system.

History and Background

Fort Bend County CAD was established in response to the growing need for a centralized and standardized system for property assessment. Before the creation of the CAD, property valuations were often inconsistent, leading to disputes and inequities in tax obligations. The Texas Legislature enacted laws to create appraisal districts across the state, including Fort Bend County, to address these issues.

Key Milestones

- 1980s: Formation of Fort Bend County CAD under Texas Property Tax Code.

- 1990s: Implementation of advanced appraisal technologies and methodologies.

- 2000s: Expansion of services to accommodate rapid population growth in Fort Bend County.

- 2020s: Introduction of online tools and resources for property owners.

Functions and Responsibilities

The Fort Bend County CAD performs several critical functions to ensure the property tax system operates smoothly. These functions include property appraisal, data collection, and public outreach. Below is a detailed breakdown of the CAD's responsibilities:

Property Appraisal

The CAD assesses the market value of all properties within Fort Bend County. This includes residential, commercial, agricultural, and industrial properties. Appraisers use a variety of methods, such as sales comparisons, cost approaches, and income analyses, to determine property values.

Data Collection

The CAD collects and maintains detailed records on property characteristics, ownership, and sales transactions. This data is essential for accurate appraisals and is made available to the public upon request.

Read also:Chinese Year Of The Snake 1965 Insights Traditions And Influences

Public Outreach

The CAD provides educational resources and support to help property owners understand the appraisal process. This includes hosting workshops, publishing guides, and offering online tools for property research.

Property Assessment Process

The property assessment process is a multi-step procedure designed to ensure fairness and accuracy. Understanding this process can help property owners better navigate their tax obligations. Here's an overview of how the Fort Bend County CAD conducts property assessments:

Step 1: Data Collection

The CAD gathers information on property characteristics, such as size, location, and improvements. This data is collected through field inspections, public records, and property owner submissions.

Step 2: Market Analysis

Appraisers analyze recent sales data and market trends to determine the market value of properties. This ensures that valuations reflect current economic conditions.

Step 3: Valuation

Using the collected data and market analysis, the CAD calculates the assessed value of each property. This value is then used by taxing authorities to determine property taxes.

Step 4: Notification

Property owners receive a notice of their assessed value annually. This notice includes details on how the valuation was determined and instructions for appealing if necessary.

Appealing Property Valuations

If you believe your property has been overvalued, you have the right to appeal the assessment. The Fort Bend County CAD provides a structured process for property owners to contest their valuations. Here's how you can file an appeal:

Step 1: Review the Notice

Carefully review the notice of assessed value you receive. Look for any discrepancies or inaccuracies in the property description or valuation.

Step 2: Gather Evidence

Collect supporting documents, such as recent sales data, comparable property valuations, and photographs of your property. This evidence will strengthen your case during the appeal process.

Step 3: Submit an Appeal

File your appeal with the CAD by the deadline specified in the notice. Be sure to include all relevant documentation and a clear explanation of your concerns.

Step 4: Attend the Hearing

If your appeal is accepted, you'll be invited to a hearing with the Appraisal Review Board (ARB). Present your case clearly and provide evidence to support your position.

Property Tax Basics

Property taxes are a primary source of revenue for local governments in Texas. Understanding how they are calculated can help you manage your financial obligations effectively. Here's a breakdown of the property tax system in Fort Bend County:

How Property Taxes Are Calculated

Property taxes are calculated by multiplying the assessed value of your property by the tax rate set by local taxing authorities. The formula is as follows:

Property Tax = Assessed Value x Tax Rate

Tax Rates

Tax rates are determined annually by school districts, municipalities, and other taxing entities. These rates are expressed in dollars per $100 of assessed value.

Exemptions and Deductions

Fort Bend County offers several exemptions and deductions to reduce property tax burdens. These include homestead exemptions, senior citizen exemptions, and disability exemptions. Property owners must apply for these benefits to qualify.

How to Lower Your Property Taxes

While property taxes are unavoidable, there are strategies you can use to reduce your tax burden. Here are some practical tips for lowering your property taxes in Fort Bend County:

Apply for Exemptions

Take advantage of available exemptions, such as homestead exemptions, to reduce your taxable property value.

Appeal Your Valuation

If you believe your property has been overvalued, file an appeal with the CAD. Providing strong evidence can result in a lower assessed value.

Improve Your Property Wisely

Make improvements that add value to your property without significantly increasing your tax liability. For example, energy-efficient upgrades may qualify for tax incentives.

Resources and Support

The Fort Bend County CAD offers a variety of resources to help property owners navigate the appraisal and taxation process. These resources include:

- Online property search tools

- Guides and publications on property assessment

- Workshops and educational events

- Customer support via phone and email

Useful Links

For more information, visit the official Fort Bend County CAD website. You can also contact their customer service team for personalized assistance.

Frequently Asked Questions

Here are answers to some common questions about Fort Bend County CAD and property taxes:

What is the role of the CAD?

The CAD assesses property values to ensure fair and equitable property taxation.

How often are property values reassessed?

Property values are reassessed annually.

Can I appeal my property valuation?

Yes, property owners have the right to appeal their valuations if they believe they are inaccurate.

Conclusion

Fort Bend County CAD plays a vital role in maintaining a fair and transparent property tax system. By understanding how the CAD operates and taking advantage of available resources, property owners can effectively manage their tax obligations. Whether you're appealing a valuation, applying for exemptions, or simply staying informed, this guide provides the tools you need to navigate the process.

We hope this article has been helpful in demystifying Fort Bend County CAD and its impact on property owners. If you have further questions or need assistance, don't hesitate to reach out to the CAD or explore their online resources. Share this article with others who may benefit from it, and feel free to leave a comment with your thoughts or experiences!

Culinary Institute Of America Tuition: A Comprehensive Guide To Costs And Financial Aid

Can You Temporarily Deactivate Snapchat? A Comprehensive Guide

Chimp Vs Orangutan: Understanding The Differences And Similarities Between These Fascinating Primates

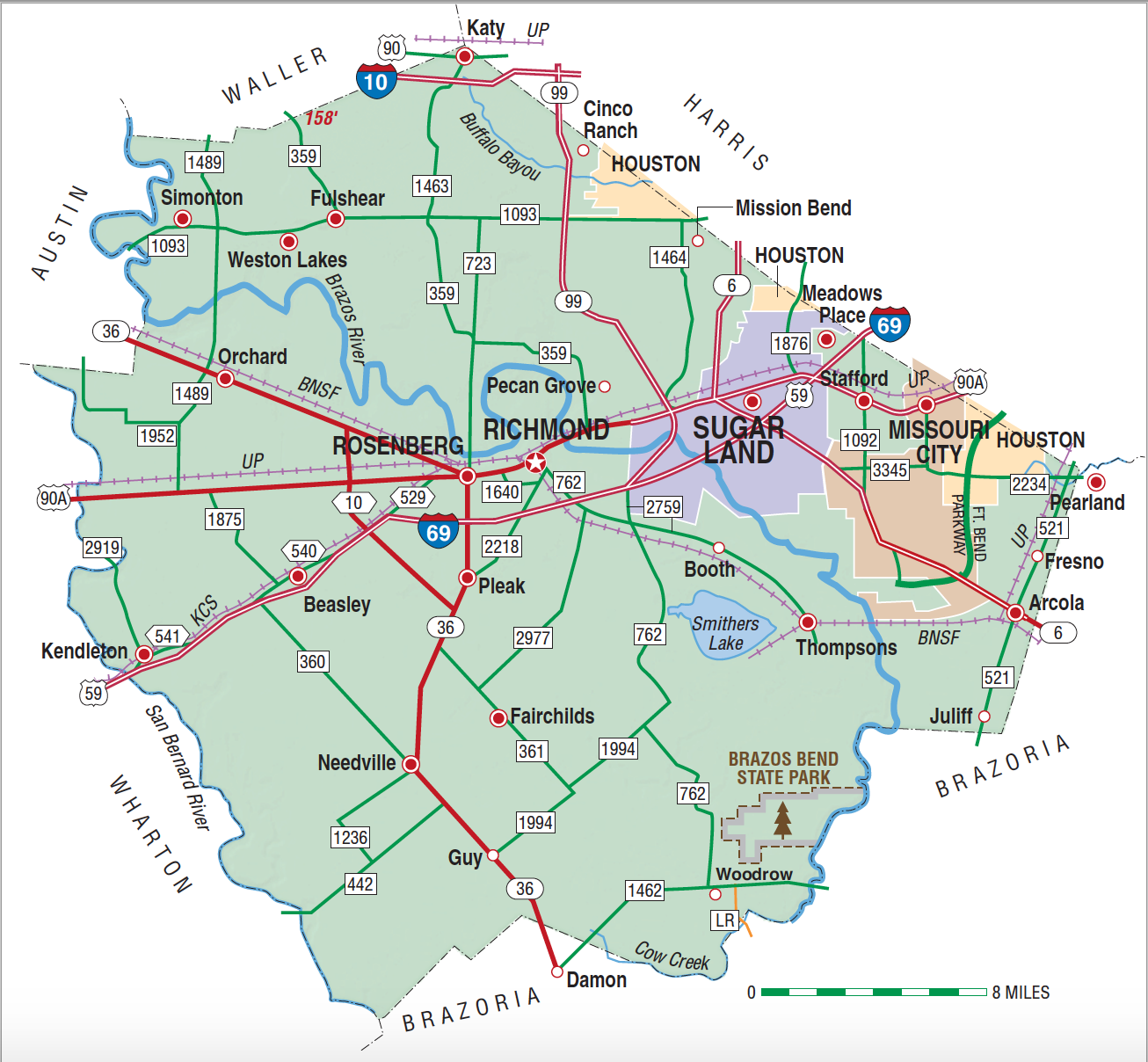

Fort Bend County TX Almanac

Fort Bend Jail Inquiry Fort Bend County