100 Trillion Zimbabwe Dollars To USD: Understanding The Hyperinflation Crisis

Have you ever wondered how a single banknote could reach a staggering value of 100 trillion Zimbabwe dollars? This astronomical figure, once a reality in Zimbabwe, serves as a stark reminder of one of the most severe hyperinflation crises in modern history. Understanding the conversion of 100 trillion Zimbabwe dollars to USD not only provides insight into this economic disaster but also highlights the importance of financial stability. In this article, we will delve into the factors that led to Zimbabwe's hyperinflation, explore the value of the 100 trillion dollar note in USD, and examine the broader implications of such economic instability.

Hyperinflation is a phenomenon that can cripple economies, erode savings, and leave citizens struggling to afford basic necessities. Zimbabwe's experience with hyperinflation is one of the most extreme examples, with the country issuing the infamous 100 trillion dollar note in 2009. At its peak, the inflation rate in Zimbabwe reached an unimaginable 89.7 sextillion percent per month. This crisis not only affected Zimbabweans but also drew global attention to the dangers of unchecked monetary policies and economic mismanagement.

In this comprehensive guide, we will explore the history of Zimbabwe's hyperinflation, the value of the 100 trillion dollar note in USD, and the lessons that can be learned from this economic catastrophe. By the end of this article, you will have a clear understanding of how hyperinflation occurs, its devastating effects, and the measures that can be taken to prevent such crises in the future.

Read also:Doraemon Nobitas Earth Symphony A Heartwarming Adventure

Table of Contents

- History of the Zimbabwe Dollar

- Causes of Zimbabwe's Hyperinflation

- The Infamous 100 Trillion Dollar Note

- 100 Trillion Zimbabwe Dollars to USD

- A Global Perspective on Hyperinflation

- Zimbabwe's Economic Recovery Efforts

- Lessons Learned from Zimbabwe's Crisis

- Impact on Zimbabwean Citizens

- The Importance of Financial Stability

- Conclusion

History of the Zimbabwe Dollar

The Zimbabwe dollar, introduced in 1980 following the country's independence, initially held promise as a stable currency. However, over the years, a combination of poor economic policies, political instability, and external pressures led to its rapid devaluation. By the early 2000s, the Zimbabwe dollar had lost much of its value, setting the stage for the hyperinflation crisis that would follow.

Early Years of the Zimbabwe Dollar

- Introduced in 1980 at par with the US dollar.

- Initially stable due to strong agricultural exports.

- Faced challenges from land reform policies in the late 1990s.

Factors Leading to Devaluation

- Land redistribution policies disrupted agricultural production.

- Increased government spending without corresponding revenue.

- Reliance on printing money to finance deficits.

Causes of Zimbabwe's Hyperinflation

Zimbabwe's hyperinflation was the result of a perfect storm of economic mismanagement, political instability, and external pressures. Understanding these causes is crucial to comprehending how the country reached the point of issuing a 100 trillion dollar note.

Economic Mismanagement

- Excessive printing of money to cover budget deficits.

- Lack of fiscal discipline and accountability.

- Failure to address structural economic issues.

Political Instability

- Corruption and misallocation of resources.

- Land reform policies that disrupted key industries.

- International sanctions and isolation.

The Infamous 100 Trillion Dollar Note

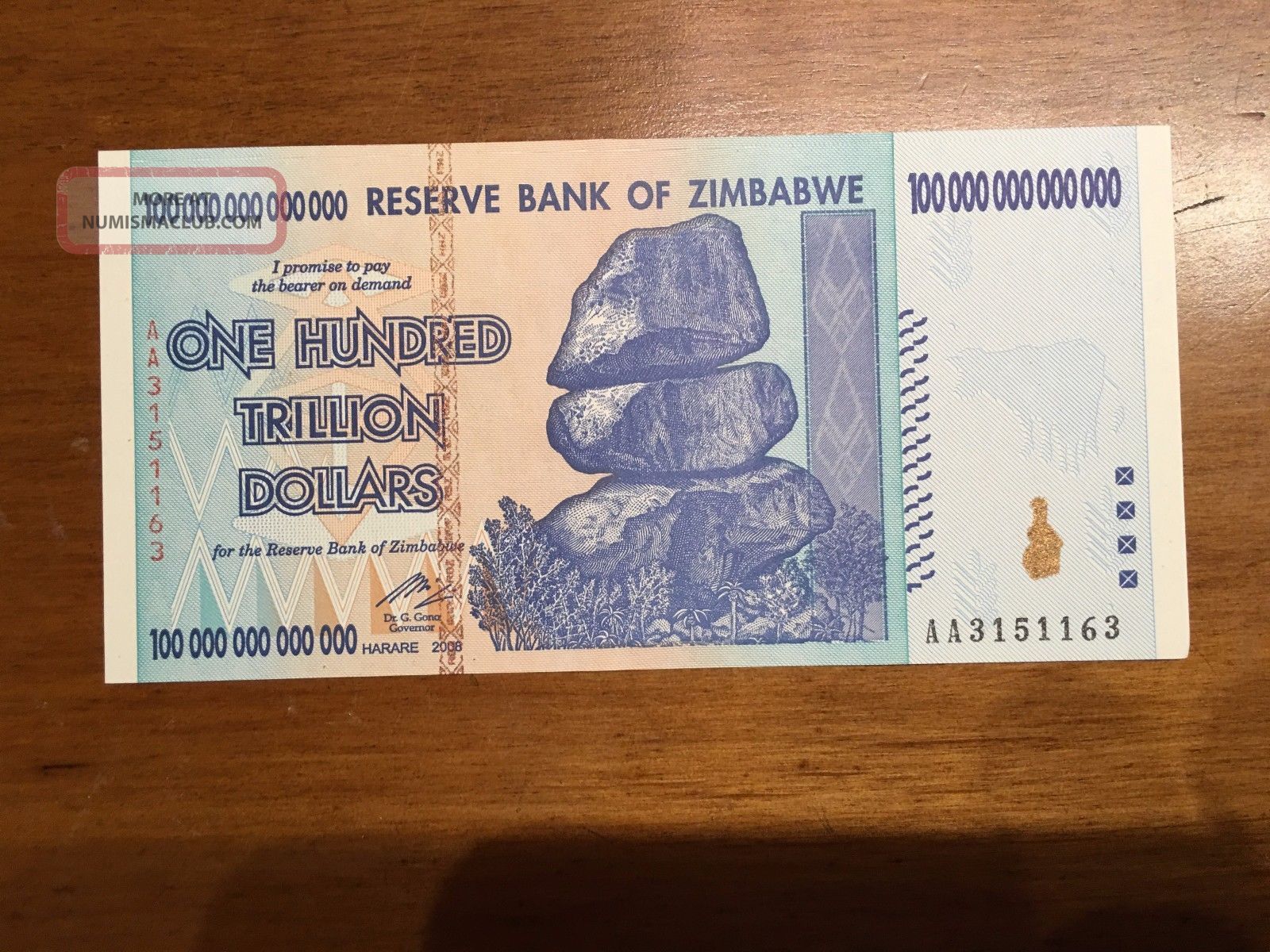

In January 2009, the Reserve Bank of Zimbabwe issued the 100 trillion dollar note, which became a symbol of the country's hyperinflation crisis. At the time, this note was worth only a few US dollars, highlighting the extent of the currency's devaluation.

Design and Features

- Printed on high-quality paper to prevent counterfeiting.

- Featured iconic Zimbabwean landmarks and wildlife.

- Carried a warning about the dangers of hyperinflation.

100 Trillion Zimbabwe Dollars to USD

At the height of Zimbabwe's hyperinflation, the exchange rate for the Zimbabwe dollar was astronomically high. By 2009, the 100 trillion dollar note was worth approximately USD 0.40 on the black market. This conversion rate underscores the severity of the crisis and the loss of value in the Zimbabwe dollar.

Factors Affecting Conversion Rates

- Fluctuating black market exchange rates.

- Lack of official currency pegs or benchmarks.

- International perceptions of Zimbabwe's economy.

A Global Perspective on Hyperinflation

While Zimbabwe's hyperinflation is one of the most extreme examples, it is not the only instance of such a crisis. Countries like Germany (Weimar Republic), Hungary, and Venezuela have also experienced hyperinflation, each with its own unique causes and consequences.

Comparing Zimbabwe to Other Cases

- Weimar Germany: Post-World War I reparations and economic collapse.

- Hungary: Post-World War II economic disarray and currency reform.

- Venezuela: Mismanagement of oil revenues and political instability.

Zimbabwe's Economic Recovery Efforts

Following the hyperinflation crisis, Zimbabwe took several steps to stabilize its economy. These efforts included abandoning the Zimbabwe dollar in favor of foreign currencies like the US dollar and implementing economic reforms to attract foreign investment.

Read also:Doraemon Body Found In Sea Unraveling The Mystery

Key Recovery Measures

- Adoption of a multi-currency system.

- Implementation of fiscal and monetary reforms.

- Engagement with international financial institutions.

Lessons Learned from Zimbabwe's Crisis

Zimbabwe's hyperinflation crisis serves as a cautionary tale for other nations. It highlights the importance of sound economic policies, fiscal discipline, and the need for transparency in governance.

Key Takeaways

- Avoid excessive reliance on printing money.

- Prioritize economic diversification and resilience.

- Engage in international cooperation and dialogue.

Impact on Zimbabwean Citizens

The hyperinflation crisis had devastating effects on Zimbabwean citizens, eroding savings, increasing poverty, and reducing access to basic necessities. Many were forced to rely on foreign currencies or barter systems to survive.

Social and Economic Consequences

- Mass unemployment and loss of purchasing power.

- Increased poverty and inequality.

- Psychological impact of financial insecurity.

The Importance of Financial Stability

Financial stability is crucial for economic growth, social well-being, and political stability. Nations must prioritize sound monetary policies, fiscal discipline, and transparency to avoid crises like Zimbabwe's hyperinflation.

Building a Stable Economy

- Implement transparent and accountable governance.

- Promote sustainable economic development.

- Strengthen institutions and regulatory frameworks.

Conclusion

Zimbabwe's experience with hyperinflation and the issuance of the 100 trillion dollar note serves as a powerful reminder of the importance of financial stability and sound economic policies. By understanding the causes and consequences of such crises, we can work toward preventing them in the future. We invite you to share your thoughts on this topic in the comments below or explore other articles on our site to learn more about global economic issues. Together, we can build a more stable and prosperous world.

Discovering London's Nicknames: A Fascinating Journey Through The City's Identity

Discover The Best GTA 5 Nice Cars: A Comprehensive Guide For Car Enthusiasts

Chelsea Hobbs: A Comprehensive Guide To Her Life, Career, And Achievements

Zimbabwe 100 Trillion Dollar Note

Zimbabwe 100 Trillion Dollar Note